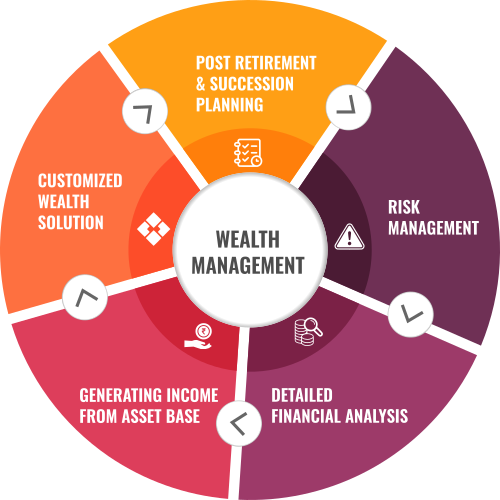

A holistic approach to wealth management encompasses a comprehensive view of an individual’s or family’s overall well-being, going beyond traditional financial strategies. It recognizes that genuine wealth extends beyond material possessions and includes things like relationships, personal fulfillment, health, and legacy planning. The concepts and advantages of a holistic approach to wealth management will be discussed in this article, along with how it can result in increased prosperity and fulfillment in all facets of life. Fundamentally, holistic wealth management acknowledges the connections between different facets of life and financial success. It highlights how crucial it is to match financial objectives with one’s values, priorities, and ambitions. Holistic wealth management aims to maximize all aspects of an individual’s life, including family dynamics, career satisfaction, physical and emotional well-being, and community involvement, as opposed to concentrating only on wealth accumulation.

The Four Pillars of Holistic Wealth Management

Financial Health: Investing, risk management, retirement planning, budgeting, and other conventional financial planning components are all included in this pillar. It entails establishing a diversified investment portfolio, defining specific financial objectives, and putting long-term wealth preservation and growth strategies into action.

Mental and Physical Well-Being: A key element of holistic wealth management is well-being. A fulfilling life is largely dependent on physical well-being, which includes healthy eating, regular exercise, and preventive healthcare. Resilience in the face of adversity and general happiness is directly correlated with emotional health, which includes emotional intelligence, stress management, and mindfulness.

Relationships and Social Connections: Having healthy relationships and social connections is important for one’s general happiness and well-being. Holistic wealth management promotes the development of deep bonds with friends, family, and neighbors. Within interpersonal and professional networks, it places a strong emphasis on communication, empathy, and mutual support.

Personal Fulfillment and Purpose: A sense of purpose and personal fulfillment go hand in hand with material possessions as true indicators of wealth. People who practice holistic wealth management are encouraged to engage in hobbies and pursuits that give them happiness, contentment, and a sense of purpose. This could be taking up hobbies, volunteering, continuing education throughout life, or working on creative projects.

Benefits of a Holistic Approach

Increased Happiness and Fulfillment: Holistic wealth management fosters a greater sense of happiness and fulfillment by taking care of all facets of life. People are happier and more fulfilled in their personal and professional lives when they make financial decisions that are consistent with their values and priorities.

Taking a holistic approach to wealth management can alleviate stress and anxiety related to financial concerns. By proactively addressing financial issues, maintaining a healthy lifestyle, and fostering supportive relationships, individuals can cultivate a sense of security and peace of mind.

Holistic wealth management encourages individuals to cultivate resilience and adaptability in the face of life’s challenges. By building strong relationships, maintaining physical and emotional well-being, and nurturing personal fulfillment, individuals are better equipped to navigate adversity and bounce back from setbacks.

Holistic wealth management takes legacy planning and impact into account after one’s lifetime. This can entail preparing an estate, making charitable contributions, and transferring morals and customs to the next generations. Through deliberate contemplation of their bequest, people can leave a lasting legacy that surpasses material prosperity.

Practical Strategies for Holistic Wealth Management

Think carefully about your values, priorities, and long-term objectives. What’s most important to you? In what way do you hope to leave a legacy? Make use of these insights to inform your lifestyle and financial decisions. Create a thorough financial plan that takes into account both your short- and long-term objectives by working with a licensed financial advisor. Budgeting, investing, risk management, retirement planning, and estate planning should all be included in this strategy. Make your mental and physical well-being your top priority by implementing stress-reduction strategies, leading a healthy lifestyle, and getting help when you need it. Never forget that the most valuable thing you have is your health. Make an effort and devote time to cultivating deep connections with neighbors, family, and friends. Robust social networks enhance your overall quality of life and offer priceless assistance.

A holistic approach to wealth management acknowledges that true wealth is more than just money; it also involves meaningful relationships, personal fulfillment, emotional and physical well-being, and a sense of purpose. A more holistic approach to financial planning and lifestyle integration can help people feel more resilient, fulfilled, and happy in all facets of their lives. Keep in mind that the depth of your relationships and the breadth of your experiences are more important indicators of wealth than the amount of money in your bank account. Accept holistic wealth management as a means of achieving long-term success and well-being.

Leave a reply